The Forex market is unique because it operates 24 hours a day, providing traders with flexibility to participate from anywhere in the world. However, while the market is always open, not all trading hours are created equal. Knowing the optimal times to trade can significantly impact your profitability. This comprehensive guide will help you understand the best Forex trading hours and how to align your strategy with market activity.

How Forex Trading Hours Work

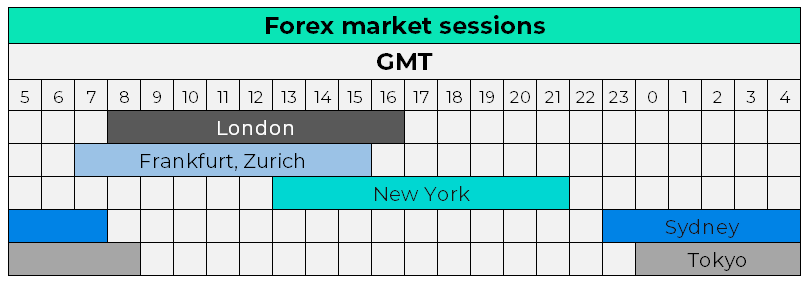

The Forex market operates across different global time zones, divided into four major trading sessions:

1. Summer time (open-close):

| Session | Local time | GMT+3 |

| Sidney | 07:00 – 16:00 | 00:00 – 09:00 |

| Tokyo | 09:00 – 18:00 | 03:00 – 12:00 |

| London | 08:00 – 16:00 | 10:00 – 18:00 |

| New-York | 08:00 – 17:00 | 15:00 – 00:00 |

2. Winter time (open-close):

| Session | Local time | GMT+2 (time change considered) |

| Sidney | 07:00 – 16:00 | 23:00 – 08:00 |

| Tokyo | 09:00 – 18:00 | 03:00 – 12:00 |

| London | 08:00 – 16:00 | 11:00 – 19:00 |

| New-York | 08:00 – 17:00 | 16:00 – 01:00 |

These sessions overlap at certain points, creating periods of heightened activity and better trading opportunities.

Understanding Forex Market Overlaps

The overlaps between sessions are critical because they are the most active and liquid trading periods. Here’s why:

- Tokyo-London Overlap (8 AM – 9 AM GMT):

- Moderate activity as the Tokyo session winds down and the London session begins.

- Ideal for trading EUR/JPY and other pairs involving JPY or EUR.

- London-New York Overlap (1 PM – 5 PM GMT):

- The most volatile and active period.

- High liquidity for major pairs like EUR/USD, GBP/USD, and USD/CHF.

Optimal Trading Hours by Currency Pair

Different currency pairs are most active during certain sessions. Here’s a breakdown:

| Currency Pair | Best Trading Session | Reason |

| EUR/USD | London-New York Overlap | High liquidity and news-driven volatility. |

| GBP/USD | London Session | Strong UK-related economic data flow. |

| USD/JPY | Tokyo Session | Active during Japan and US economic releases. |

| AUD/USD | Sydney Session | Correlates with Australian economic activity. |

| USD/CAD | New York Session | Influenced by US and Canadian data releases. |

Best Times to Trade Forex

- During Market Overlaps

- The London-New York overlap is particularly lucrative due to the sheer volume of trades and news-related price movements.

- During Economic Announcements

- Economic releases, such as interest rate decisions and employment data, create significant volatility, offering high-profit opportunities.

- Avoid Low-Activity Periods

- Late Sydney session and early Tokyo session are often quieter with limited volatility.

Tips to Optimize Your Forex Trading Strategy

- Use Economic Calendars

- Stay updated on key economic events and schedule your trades around major announcements.

- Focus on High-Volume Hours

- Liquidity is highest during overlaps, reducing spreads and improving execution.

- Tailor Your Strategy to Volatility

- Scalpers can thrive in volatile markets, while swing traders may prefer steady trends.

- Adjust for Time Zones

- Align your trading hours with the sessions most relevant to your chosen currency pairs.

- Risk Management

- Use stop-loss orders and trade sizes appropriate for the volatility of your trading hours.

Trading Hours to Avoid

- Late Fridays: As the market winds down, liquidity decreases, leading to wider spreads.

- Holidays: Major holidays like Christmas or New Year’s Day result in low market activity.

Conclusion

The best Forex trading hours depend on your strategy, currency pairs, and trading style. By focusing on session overlaps, monitoring economic releases, and aligning your approach with market conditions, you can maximize your trading potential. Success in Forex isn’t just about timing but also about preparation, analysis, and discipline.

Take advantage of tools like economic calendars, volatility indicators, and demo accounts to refine your strategy further. For any Forex trader, understanding market hours is a cornerstone of success.